Common Estate Planning Pitfalls

By Adil Daudi, Esq.

If you’re one of the few Americans who managed to establish a sound estate plan, congratulations. However, it is important to not only have an estate plan in place, but to also periodically have it reviewed. A common mistake for clients is to pay the money for a plan, but then to ignore it and not properly manage it, thus making it ineffective when it comes time for it to be of use.

Therefore, once your estate plan is in place, try to avoid these common pitfalls:

1. Not Funding your Revocable Trust: I’ve come across many clients who informed me that they purchased a Trust, but have not had it “funded,†i.e. having the assets transferred to the trust. Failing to do so would result in putting your loved ones through the expensive and lengthy draining court probate process.

2. Failing to understand the impact of life insurance proceeds: Many clients are ill-advised when it comes to their life insurance proceeds. They are normally included in the estate of the deceased. This could possibly result in approximately 35%-50% (depending on tax year) of the proceeds being paid to the IRS in estate taxes, instead of your beneficiaries. Looking into an Irrevocable Life Insurance Trust could save several hundreds of thousands of dollars in estate taxes.

3. Business Planning: By having a properly executed plan, you have the ability to choose who will own and control your business after your demise. However, this needs to be mentioned as part of your plan.

4. Improper Beneficiary Designations: Even after establishing your plan, be sure to update all of your beneficiary designations on your life insurance policies, bank accounts, IRA’s, 401K’s. and any other assets that can lead to unintended beneficiaries.

5. Not Preparing for Minor Children: One of the biggest mistakes people make with their estate plan is not having the proper precautions for protecting their children. If you have minor children, you should always be sure to have personal guardians nominated for the children, in the event that both you and your spouse should die prior the children reaching the age of 18. Without this in place, the court will decide without your input where the kids will live and who will make important decisions about their money, education and life.

6. Not Reviewing your Estate Plan on Regular Basis: It is understandable for people to not enjoy discussing their estate plan after it is executed, as it entails the discussion of death. However, reality needs to play a factor and understand that economic, family, and health changes require revisions to an estate plan. I normally suggest a formal review of an estate plan every two years to determine if any changes to it are required.

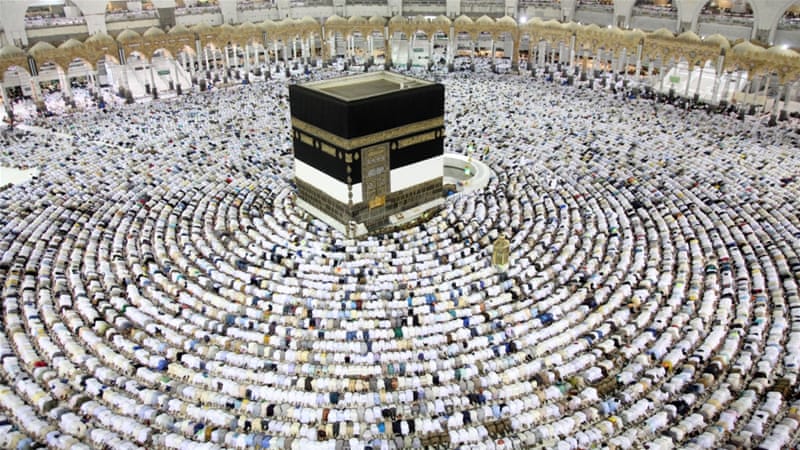

Adil Daudi is an Attorney at Joseph, Kroll & Yagalla, P.C., focusing primarily on Asset Protection for Physicians, Physician Contracts, Estate Planning, Shariah Estate Planning, Health Care Law, Business Litigation, and Corporate Formations. He can be contacted for any questions related to this article or other areas of law at adil@josephlaw.net or (517) 381-2663.

14-36

2012

831 views

views

0

comments